Vizsla Silver Has An Exceptional Silver Development Project

The bullish arguments for silver are extremely compelling, what is challenging is to find great silver stocks. So I’m very pleased to report that Vizsla Silver, which has the best silver development project in the sector, has become a new sponsor at Rocks And Stocks News.

This will enable me to produce plenty of content in reports and interviews to give my audience a front row seat to follow the evaluation of Vizsla Silver. From a silver mine developer into a high-grade silver miner with a project that is in the lowest cost quartile for undeveloped silver mines.

The supply and demand story for silver is remarkable as the physical demand is significantly higher than physical supply. There is a supply deficit now that will grow larger. Due to the dearth of silver projects in development and too few silver exploration projects with important discoveries. Plus the powerful demand from traditional sources such as silver jewellery, silver as a monetary metal, silver used in electronics and explosive growth from silver needed to make solar panels. This has created an extremely bullish supply and demand scenario for the price of silver.

I’ve been following Vizsla Silver since they made their early discovery holes and since due to the extreme high-grade over impressive intersections in an epithermal vein system. Their Panuco project is in a well-known part of Mexico that is a world class region for silver mining.

The key recent milestone is their preliminary economic assessment (PEA) that has a base case internal rate of return (IRR) of 86% using silver and gold prices significantly lower than current prices. Using prices closer to the current spot prices pushes the IRR into the triple digits. These days, a development project in any metal is considered to be impressive if it has a 30% IRR, with most mines operating with less than that number. The IRR of Panuco is off the charts relative to other precious and base metal development projects.

Another key metric I focus on in a development company is the capital cost to build the mine. Currently, most mines in development start at around $1 billion and go up from there. Panuco has an estimated capital cost of $224 million which makes it well within reach of a junior like Vizsla Silver.

The extremely high IRR is because of their all-in sustaining cost of $9.40 per silver equivalent ounce. The PEA includes an average annual production of 15.2 million silver equivalent ounces of silver.

To get a sense for how robust the economics are on any project, a common metric that people in mining consider is how quickly the capital costs to build the mine will be paid back from production. Due to the relatively low capex, and the low cost of production and the amount of silver equivalent ounces to be produced in the first year, the estimated capex payback in the PEA is only 9 months.

That rapid payback makes the Panuco project (I’ll borrow a term used in the technology sector) a unicorn in mining.

Resource estimates that go into PEAs are snapshots in time and I think it is important to look at how they can grow the silver and gold ounces in the ground for production beyond what is contemplated in a PEA.

The metrics in their PEA makes them a special situation relative to their peers. But, I’m an exploration guy at heart having spent 30 years in exploration. I love the search for buried treasures using the drill rig to find buried treasures. As exceptional as their PEA is, they also have an explorer’s dream project.

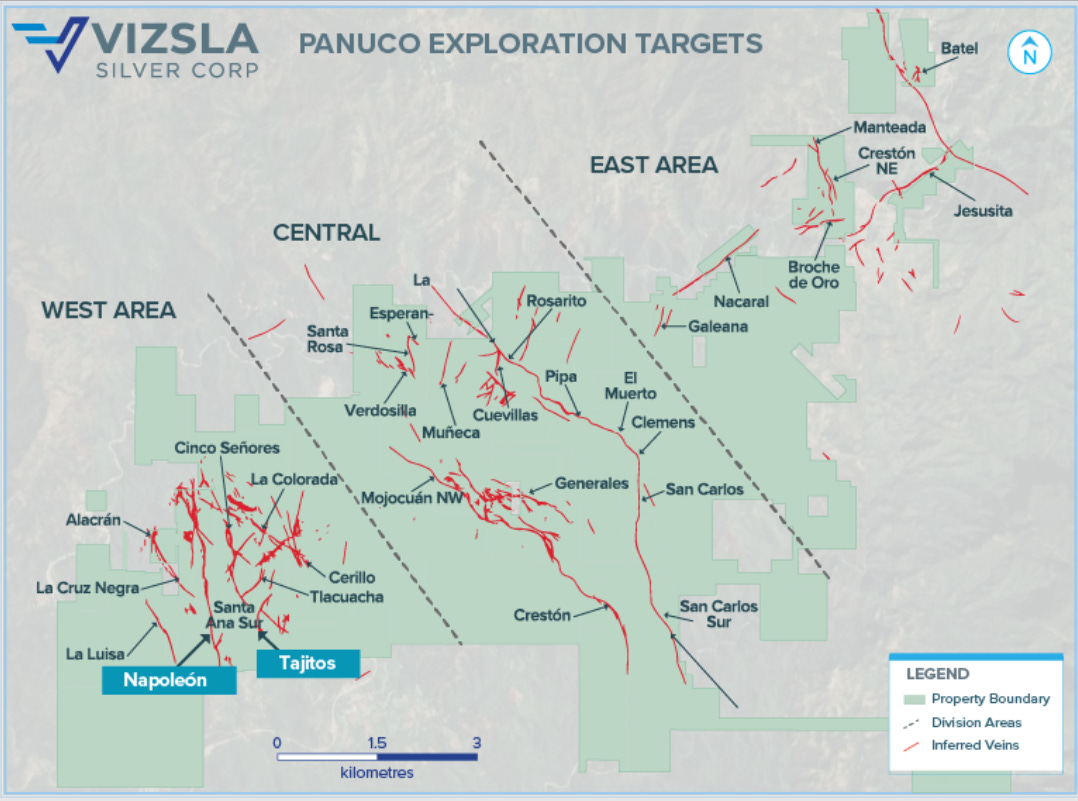

At Panuco, they have a cluster of epithermal veins, with the bulk of their drilling on only a few of them. Outside of the ones where they have done most of their drilling, they have several more that need to be drilled.

When I look at the cluster of epithermal veins at Panuco, it reminds me of the cluster of epithermal veins immediately around the city of Fresnillo which is a couple hours drive away from Panuco.

The town of Fresnillo was built in the 1500s to mine a series of epithermal veins, in modern times the Saucito series of veins was found a couple thousand metres away and MAG Silver’s Juanicipio mine is the extension of the Saucito veins. Within a 10km radius is a cluster of epithermal veins that could easily fit within the claims that Vizsla Silver has at their Panuco project.

The veins at Fresnillo and Saucito outcrop so they were found as they are exposed at the surface. While the Juanicipio and Valdecanas veins are blind as they don’t come to the surface. That is the nature of epithermal vein clusters, some come right to the surface so they can be walked over, others are buried below the surface.

I recently did an interview with Michael Konnert, the CEO of Vizsla Silver (you can find it here), in which he discussed how they found blind veins at Panuco. So, not only do they have many outcropping veins to drill, the potential to find high-grade blind veins also exists at Panuco.

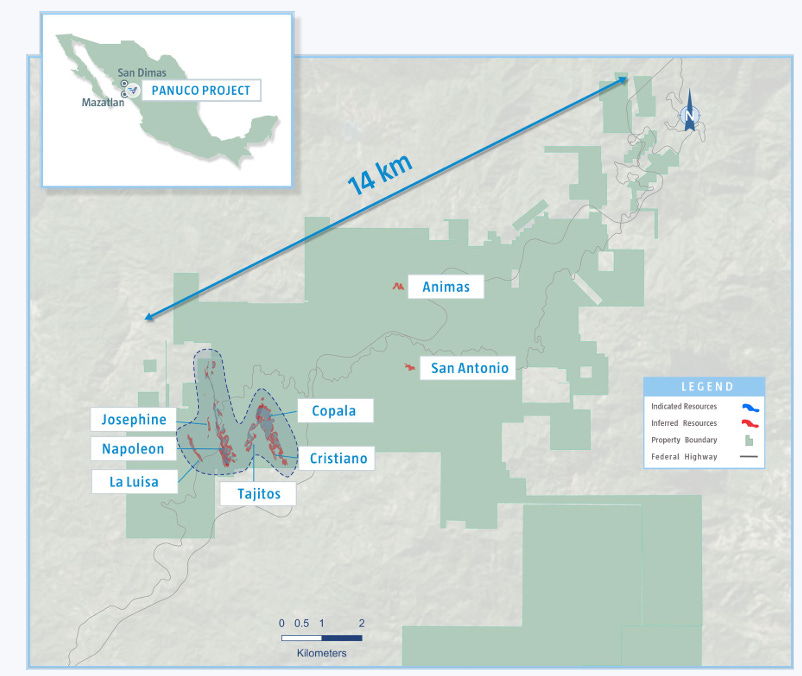

The next two maps will give you an idea of the veins they have for exploration and what was included in the PEA. The first image is the known veins and the second are the ones that went into the PEA.

As you can clearly see, they have only really started to get to a small portion of the veins in the cluster and have plenty of room to grow their ounces of silver and gold in the ground.

One of the great ways to find blind veins in an epithermal vein cluster is through drilling. In the recent interview I did with Michael Konnert, he talked about the hole they were drilling for another vein and tagged the Copala vein on the way to the other vein. The Copala vein is a spectacular vein and it goes to show why geologists will always say exploration drilling is part science and part luck.

Mines always come with many pleasant surprises along the path from discovery to mining and even while in production. Copala was one of those pleasant surprises and there very well could be more lurking, based on my experiences in exploration, I believe there is a high probability of it.

Most often, investors in exploration stocks tend to disregard infill drilling as they believe that they are “just” drilling between two holes where they already know there is mineralization. Recently, Vizsla Silver reported infill holes that add significant amounts of new mineralization that are not included in their resource estimates and they came in at higher grades than the average grades of the resources.

To put those grades into context, there are highly profitable Mexican silver mines that are producing silver from epithermal veins at much lower grades.

These holes are a perfect example of a trend that my mentor in geology told me about a long time ago that I never forgot. He said that all exploration projects start out with big targets that usually get smaller as they are drilled. While mines are different, they get better and better the more you drill them. The above holes are additional pleasant surprises they have found at Panuco and show what my mentor was talking about.

Recently, they completed their infill drilling and next they will switch to exploration drilling to test additional targets. I’m looking forward to seeing the results from their exploration drilling and like their chances for more pleasant surprises.

Epithermal veins are often found in clusters and what you find in one can be an indication of the rest because the fluids bearing the metals come from the same source. You can think of it like a boiling pot of water, above it are cracks in the rocks and the boiling water flows up into those cracks carrying silver and gold. Often multiple times over millions of years.

When you hear explorers talk about epithermal veins you will hear the term the boiling zone. Some also call it the bonanza zone. Once you know how deep the boiling zone is on one vein in a cluster you know the approximate depth to target on other veins as they will have a similar depth to reach the boiling zone. From the veins they have already drilled, they have gained that crucial information.

Once I look at a project's drilling results, then I look at the people involved in running the company. Vizsla Silver has an exemplary board that can take the project to production and beyond.

One of their key people is Simon Cmrlec, COO of Vizsla Silver, who is a mining engineer with a 30-year career including recently being the COO at Ausenco which is a world leader in mining engineering and consulting.

While at Ausenco he built 42 mines including the Las Chispas mine for SilverCrest. Which was built on time and on budget while contending with constructing while going through Covid and dealing with significant inflation. Building mines on time and on budget is no small feat, dealing with the issues at Las Chispas was extremely impressive and testament to their expertise.

Las Chispas is in Mexico and is an underground mine producing silver and gold from epithermal veins. Vizsla Silver really couldn’t have a better person on their team to build Panuco into a mine.

On the exploration front, their VP Exploration, Jesus Velador, is equally as talented in exploration as Simon Cmrlec is at building mines. Prior to joining Vizsla Silver he was the manager of brownfields exploration for Fortuna Silver in Mexico and Peru. Before that he managed the exploration for First Majestic from discovery through production at their Ermitano mine, which is one of First Majestic’s best performing silver-gold mines, and like Panuco it is an epithermal vein system.

Jesus Velador started his 20-year career with Penoles where his work was instrumental in finding the Valdecanas vein at the Juanicipio project which is owned by a joint venture with MAG Silver and Fresnillo Plc. While there he got to work closely with Peter Megaw, considered one of the top experts in epithermal vein systems worldwide. Once again they are coming together at Vizsla Silver as Peter Megaw is an advisor to Vizsla Silver.

During his career, Jesus Velador has been laser focused on epithermal vein systems, so the company is in great hands on the exploration side. Jesus Velador has been blessed to work on some of the top epithermal vein mines found and built over the past couple of decades in Mexico. Now he has a chance to do it again at the Panuco project and I think he is the right person for the job and it will prove to be another big success in his career.

In addition to Michael Konnert as CEO, Simon Cmrlec as COO and Jesus Velador as VP Exploration, they also have a team of very talented mining executives on their board and part of the management team. With all the experience needed to build Vizsla Silver from a silver mine developer into a high-growth silver miner.

In Closing

From a big picture perspective, when I think of Vizsla Silver it reminds me of where Barrick Gold started their path to success. They started out as a small junior that put an exceptional mine into production and used that as the foundation to grow into one of the biggest gold mining companies in the industry.

Vizsla Silver has their foundational project at Panuco to transition them to a highly profitable silver and gold miner.

During the last gold-silver bull market from 2001 to 2011, there were a lot of mergers and acquisitions that created a situation where there aren’t a lot of small high-growth miners and mid-tier producers today.

This has created a vacuum in the silver and gold mining industry. There are projects out there that are not big enough to move the needle for the behemoth major mining companies. But, they could be company makers for smaller miners or certainly be part of the growth story for them to grow into a much larger silver and gold miner.

To take advantage of those opportunities needs a project like Panuco that can create the balance sheet needed and also the team to execute on that path of growth. Vizsla Silver checks all the boxes.

All the best,

Allan Barry Laboucan

Disclosure

Vizsla Silver is a sponsor of Rocks And Stocks News, content creation about them is for the benefit of the company. Sponsors also benefit readers of the reports as it makes content creation possible for no charge to readers.

Rocks And Stocks News does not make buying or selling recommendations. The reports are for information purposes only. Sponsors pay a fee to Rocks And Stocks News for content creation. The business model of Rocks And Stocks News is to fund research and reporting on the sector, picks and sponsors through corporate sponsorship. We are thankful to sponsors for enabling commentary free of charge to readers and viewers of the reports. When reporting on sponsors it is on behalf of the sponsors discussed in the portion of the report mentioning the sponsor. Before making any investment decision it is important for you to speak with your financial advisors to consider your risk profile. It is also important to do your homework. To help in that process, Rocks And Stocks News means to be a gateway by doing reports and interviews of management of sponsors and picks. The reports and interviews should not be considered investment advice. Allan Barry Laboucan is the founder and owner of Rocks And Stocks News, he has worked in the mining sector since 1993 and has been reporting on the sector since 2005. He has worked with and been mentored by very talented geoscientists in geology, geochemistry and geophysics. He uses the skills he has picked up during his career to assess sponsors and picks in the reports. Whether a company is a pick or a sponsor they go through the same filter and are reported on when important news is made that Allan Barry Laboucan wants to discuss on the Rocks And Stocks News platform. He may own shares in sponsors and picks for investment purposes which he discloses when discussing them in the reports.