Jobs Market And Economy Slowing - Rate Cuts Coming That Will Drive The USD Down And Gold Up

Economists at the Fed are behind the curve when it comes to the health of the jobs market and the economy. They are going to have to cut a lot more than is being discussed to avoid a steep recession.

The US dollar (USD) traders see the problem that is coming; they are preparing for the Fed to not only cut rates, but the cycle will move them back toward the Free Money, not a series of mild quarter-point cuts.

The first chart of the USD index shows us that if one wants to get a clear picture of where interest rates are going; the currency traders are better to follow than the Fed.

I would first point to the double bottom in late 2020 and early summer of 2021. After that the trend got stronger as the USD traders could see inflation was not transitory and that the Fed would need to cut rates.

When they did, the USD went into overdrive until it reached its peak in the second half of 2022. The USD traders were well ahead of the curve on interest rates, which was not an easy trade to make because the Free Money Era had lasted so long. But, they saw the writing on the wall that inflation was not transitory and the Fed would have no alternative other than to go into a rate hiking cycle.

The next chart shows that the USD traders are once again seeing the writing on the wall and anticipating that the economy is slowing and could head into a recession and the Fed will need to cut rates. Not mildly, but to head back toward the Free Money Era, plus increase their balance sheet.

Daily chart of the USD index above is courtesy of Finviz.com

During the past year the USD topped in October, 2023 with a double top and then corrected to finish the year. Then it rallied until the top in April, 2024, which was a lower high than the previous top. It came down mildly from that April high, then rallied slightly in June for another lower high.

Since then, it has made a series of lower highs and lower lows, taking it down steeply. What likely spooked them was that the jobs market was shedding full-time jobs and gaining part-time jobs with workers losing full-time jobs to take on a couple part-time jobs to make less money.

The weakness in the jobs market was confirmed when the BLS had to come clean that they had been overstating the jobs numbers and had to revise the numbers downward. Basically wiping out all of the strength in the jobs market that the Biden administration had been bragging about and that the Fed was using as a reason to keep rates higher for longer.

At the far right of the chart you will see a dead cat bounce, which by definition are short term moves. The steep decline is suggesting that the USD traders are anticipating that the Fed is going into a significant rate cutting cycle to stave off a severe recession. The dead cat bounce is due to it sounding like the Fed will cut a quarter-point in September with a few more cuts like that to follow in subsequent meetings.

The next chart sends the message that the concerns about a hard landing are taking shape for the economy and is why the USD has seen a series of lower highs and lower lows of late.

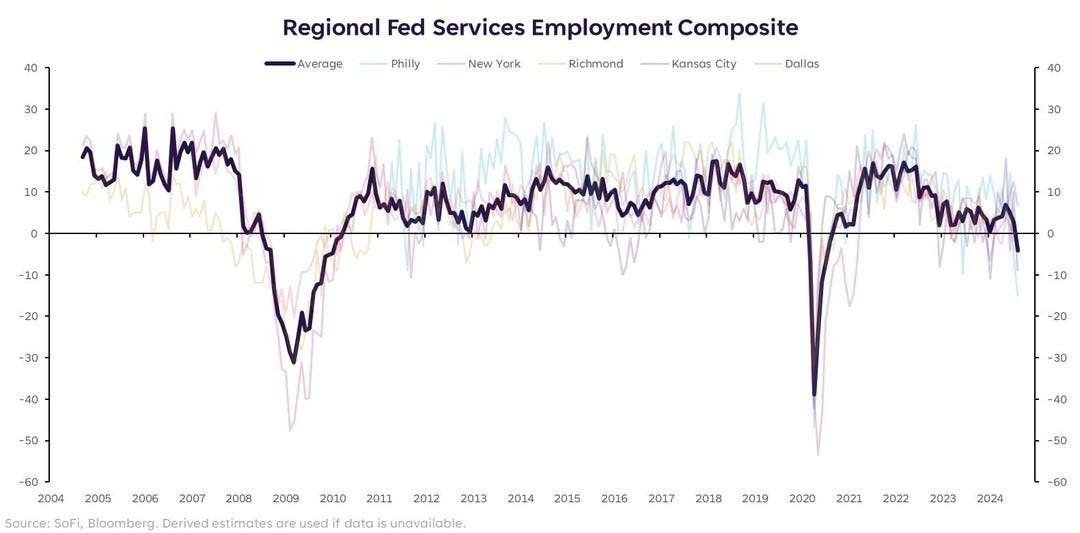

The health of the jobs market always tells us where the economy is heading and it doesn’t look good as can be seen in the chart below.

First, I would point to the strength in the jobs market prior to the 2008 GFC. The decline took around one year to bottom and then a couple years to regain all the loses. Despite the Fed slashing rates to build the Free Money Era, it never fully recovered back to the pre-2008 GFC level.

It had a spike to the downside due to Covid when they pumped a lot of liquidity into the system by sending out cash to consumers, then it spiked back up. Since early 2022, it has been softening and then in the past few months has dropped precipitously.

This is suggesting that another steep drop is coming. Which is what has the USD index in a steep correction with a series of lower lows and lower highs. The slowing and then recent drop is suggesting that the jobs market is in trouble and that the economy is heading toward rough waters.

It certainly doesn’t look like a soft landing is coming and that it will be a hard landing. What kind of a landing will depend on how aggressive the Fed cuts rates. I can’t see how a series of mild quarter-point cuts will avoid a hard landing.

They have an immediate predicament: if they cut by a half-point in September, they could spook people into thinking that they are concerned about a hard landing. If they don’t they could lose the chance to orchestrate a soft landing.

Painting themselves into corners is what the Fed constantly does because their models are built on data from the past, they aren’t built to project trends into the future. Their plotting of the economic dots has them painted into a corner once again.

It is reminiscent of when they thought inflation was transitory. It wasn’t, which caused them to go into an aggressive series of rate hikes.

Once again they are behind the curve and they aren’t going to have the luxury of being wrong for long. The trends in the jobs market are there for everybody to see. The trends are heading into a significant drop for both jobs and the economy.

Which is why the Fed declared victory over inflation at the Jackson Hole economic conference and signalled that a rate cutting cycle is coming and likely to start in September. They can’t say it, but their higher for longer policy is creating serious economic problems and they have to change course immediately.

Most believe that it will start with a quarter-point cut and it won’t be a half-point cut. I don’t think the Fed wants to cause panic with a half-point cut, but they are on thin ice and their decision will be dependant on how the economic numbers come out between now and the September meeting,

Of course they can’t say that the ice is thin between a soft landing and a hard landing, but it is without a doubt.

Looking out to how long the rate cutting cycle will last and how deep it will go brings up other issues. If they go back toward the Free Money Era, it will throw the USD under the bus. If that happens, as the US is such a big importer it will cause the inflation to kick in more than they would like.

Plus, there is a Death Spiral of Debt which has got worse since the 2008 GFC, due to the insane spending of politicians. Which is so severe that servicing the debt is now over $1 trillion and heading to $2 trillion. The two candidates are spending junkies and will likely see $3 trillion deficits throughout their term.

Rocks meet hard places.

The Fed is faced with a soft landing or hard landing dilemma, made worse by them always being behind the curve and politicians that don’t know how to cut spending.

It often looks like Powell is more concerned about his legacy than actual economics. He wants to go down as the guy who beat down inflation, while conveniently forgetting the part about the Fed’s Free Money Era that enabled the politicians to go on a spending spree which caused the inflation.

It will tarnish his legacy if he drives the economy into a hard landing and then gets fired if Trump wins the election. He may not have said anything about the BLS revisions to the jobs numbers at the Jackson Hole conference, it certainly had to be on his mind which is why he declared victory over inflation.

I guess I shouldn’t consider economics as much when thinking about their next moves and focus on how it will affect Powell’s legacy. That is a pretty sad state of affairs when economics doesn't matter as much as the Fed head’s legacy when it comes to interest rate policy. But this is where we are now when it comes to economic policy.

With the struggles in the jobs market signalling that the economy is going into rough waters, it certainly looks like his legacy and job are in jeopardy.

It’s been clear that the trend of workers losing full-time jobs to take on part-time jobs to make less money is troublesome. An indication of just how strapped the consumer is came from Dollar General who saw their stock get hammered when they reduced their outlook indicating the reason is their customers are cash-strapped.

A chain is only as strong as its weakest link and if consumers are so tight for money that they have to cut back on spending at dollar stores, the chain is broken.

In the past Powell said he didn’t want to wait too long to cut rates in fear it could push the economy into a severe recession. He also said that they wouldn’t wait until the PCE got down to 2% because then it would be too late.

Normally, the Fed wouldn’t make a move so close to the election, but they say that won’t affect their decisions as it will be data driven. The BLS revisions spooked the USD traders and sent gold higher, they are pricing in a rate cut for sure at the September meeting.

Even if they cut by one-point before the end of the year, it won’t do much for the pace of growth in the costs to service the debt.

How much they cut depends on whether they caused a soft landing or a hard landing.

I’m sure the Fed would like to see the next president show some fiscal restraint. But, both the candidates have proven their preferences to spend like drunken sailors. I sure hope it isn’t VP Harris because in addition to being a massive spender, her economic plans are economic suicide.

What Is An Investor To Do

First, be aware of the reality of the economy, at best it is a soft landing and at worst is a hard landing. Secondly, the Death Spiral of Debt is only going to get worse, no matter which candidate gets in as they are both massive spenders. Finally, if you haven’t already thought about putting yourself on the Gold Standard, it is time.

Gold is the cure to the pains caused by the Fed and politicians.

Gold futures chart above is courtesy of Finviz.com

Gold is in a powerful bull market, during 2024 it has made a series of higher highs and higher lows. Combined with the issues mentioned earlier in the report there are also other key contributing factors.

The central bankers in the BRICS nations are returning to the Gold Standard, they want an alternative to the USD as the world reserve currency and they want to own less US debt.

With these countries not only selling US debt, they aren’t buying either. This is a key reason that in addition to the Fed cutting rates, they will also need to be the buyer of last resort in a recession, either a soft or hard landing, and increase their balance sheet.

For investors in Wall Street stocks, I think they should pay attention to Warren Buffet building up more cash than he ever has in the past. His actions have been to take profits and build up cash. He doesn’t make his moves due to market timing, he is finding a lot of stocks are richly valued and he is having troubles finding good value to put his cash to work.

Valuations on Wall Street stocks are very stretched, especially when it comes to the most popular names in tech. It is certainly time to be more defensive and look for stocks that make good money during slowdowns in the economy.

Speaking of stocks that are making good money, some select gold miners are doing extremely well on their bottom lines with the strength in gold.

Take for example our top pick of the Big 3 gold miners, Agnico Eagle, is making tons of money. They have had three consecutive quarters of record free cash flow. Plus, they are making efforts to increase their production and bring down their costs of gold production.

They are easily beating the other two in the Big 3, Newmont and Barrick, in their operations and stock performance. With the increase in the price of gold in the third quarter, they are primed to make a new record quarter in free cash flow.

Alamos Gold is much smaller than the Big 3 gold miners, but they are hitting above their weight class when it comes to record free cash flow set in the second quarter of this year.

Even more impressive is that they are moving forward on efforts to increase their production. They are already producing gold for well under the average price for gold miners, and they are on a path to bring their all-in costs to below $1000 per ounce. They certainly aren’t as well known by generalist investors compared to the Big 3, but they are a very impressive gold mining company.

When you have gold miners like Agnico Eagle and Alamos Gold hitting it absolutely out of the park setting new records for free cash flow, it will catch the attention of astute generalist investors. They both look to have excellent quarters ahead of them executing on their operations so impressively and will benefit tremendously from higher gold prices.

These two are showing just how good the gold mining business can be when companies are well run. They are two key catalysts to drive the gold stocks into the gold bull market.

Ultimately, the generalist investors will be paying more attention to the gold miners. Our top two picks for gold miners are leaders that will lead the way. As generalist investors join the gold bull market, they will undoubtedly get bullish on gold stocks.

When it comes to the gold miners, they will first focus on the Big 3 with Agnico Eagle being the best in breed. Then they will move down to the mid-tiers with Alamos Gold being the best in breed in that class.

We are seeing signs of the gold mine developers starting to wake up, but there is a small menu in that category. Some of the gold explorers with high-quality discoveries are coming off the canvas as well.

Gold is primed to move much higher, I see $3000 per ounce in the cards for this year or in early 2025 at the latest. The real torque is in the high-quality gold miners, gold mine developers and gold explorers with important discoveries.

All the best,

Allan Barry Laboucan

Disclosure

Rocks And Stocks News does not make buying or selling recommendations. The reports are for information purposes only. Sponsors pay a fee to Rocks And Stocks News for content creation. The business model of Rocks And Stocks News is to fund research and reporting on the sector, picks and sponsors through corporate sponsorship. We are thankful to sponsors for enabling commentary free of charge to readers and viewers of the reports. When reporting on sponsors it is on behalf of the sponsors discussed in the portion of the report mentioning the sponsor. Before making any investment decision it is important for you to speak with your financial advisors to consider your risk profile. It is also important to do your homework. To help in that process, Rocks And Stocks News means to be a gateway by doing reports and interviews of management of sponsors and picks. The reports and interviews should not be considered investment advice. Allan Barry Laboucan is the founder and owner of Rocks And Stocks News, he has worked in the mining sector since 1993 and has been reporting on the sector since 2005. He has worked with and been mentored by very talented geoscientists in geology, geochemistry and geophysics. He uses the skills he has picked up during his career to assess sponsors and picks in the reports. Whether a company is a pick or a sponsor they go through the same filter and are reported on when important news is made that Allan Barry Laboucan wants to discuss on the Rocks And Stocks News platform. He may own shares in sponsors and picks for investment purposes which he discloses when discussing them in the reports.