Gold Is Short-Term Oversold With Rate Cuts Coming Toot Sweet That Will Put Pressure On The USD And Drive Gold Higher

Featured companies in this report include Goliath Resources, Juggernaut Exploration and Borealis Mining.

Gold is in a powerful bull market as the world returns to the Gold Standard. But, in every bull market, regardless of the asset, things can get short-term oversold. That is exactly where we are now with imminent interest rate cuts.

The Wall Street stocks got hammered after the Fed stood pat on rates last Wednesday. The Street was additionally spooked on Friday when the unemployment came out higher than expected. Monday extended the correction after global stocks opened on Sunday night and got the beat down.

After three days of steep declines on Wall Street, a slight bounce like today does not mean they are out of the woods. Far from it. Nothing has really changed despite a slight dead cat bounce.

As far as Wall Street is concerned, they are still concerned the Fed dropped the ball by not cutting rates on Wednesday. The job market is still in trouble. A recession that could turn severe is still looming. And they likely won’t feel better until the Fed cuts rates.

There are plenty of landmines that could cause more corrections in Wall Street stocks as they are on shaky ground. It may not even take jobs data that is coming out later this week. It could be as simple as the dead cat bounce being tepid compared to the three-day correction. A well known economist could come out and cause panic selling. The list of triggers are many.

Wall Street is convinced that the Fed is behind the curve, playing a risky game with rates being too high that could cause a severe recession. One of the key signals is the troubles for the job market if you get past the noise in the headlines. Losing full-time jobs and replacing them with part-time jobs does not make for a strong job market.

The potential for a rate cut between meeting is not off the table. A rate cut in September is as close to a certainty as it can get. A cut of half a point or more is not off the table for September. Another thing that is not being talked about a lot is that as they raise rates, they will also get back into increasing their balance sheet.

Ultimately, rates heading back toward Free Money and the Fed dramatically increasing their balance sheet is coming.

The Death Spiral of Debt and rapid increases in servicing the debt is going to drive them back to the QE business. The next president, whether it is Trump or Harris, have both shown their affinity to insane spending and the Death Spiral of Debt is only going to get worse.

The probability that the Death Spiral of Debt is going to get worse and a return to the Gold Standard is getting higher by the day.

Gold Stocks Are Ready To Rumble

Several gold miners are making money hand over first with the price of gold around $1000 above the industry average of costs of producing gold which is around $1400 per ounce. This is a recipe for incredible free cash flow growth.

Giving gold miners the ability to show generalist investors that gold mining is a great business, getting greater, able to compare free cash flow growth against many industries.

We are at the inflection point that will bring more generalist investors into gold stocks and a crowd will start to form. There is still an opportunity to get ahead of the crowd, but those days are getting fewer.

I’m very impressed that the gold miners have already started to join the party, the market is separating the wheat from the chaff nicely. Those being the most rewarded, at this point, are the gold miners that are reporting record free cash flow, with the ability to increase production and bring down costs.

Those that are doing that are the cream rising to the top and outperforming their peers by a significant margin.

What I expect next is that more gold miners will get stronger. Even if they have higher costs and are struggling on the free cash flow growth, and growing production, and bringing down costs, the price of gold is helping their bottom lines as well.

As the gold stocks enter the gold bull market and a crowd of generalist investors form, I expect to see a significant improvement in gold mine developers and explorers with impressive discoveries. The problem for generalist investors is that as they look down the gold stock food chain, the menu of great opportunities is very small.

The gold mining industry drastically needs more gold mine developers and explorers with great discoveries. Basically because the majors are depleting their gold mines daily and they need to replace them, but they are struggling. Plenty of gold miners are struggling to increase production.

Even though gold is in a powerful bull market, production has peaked and is heading toward many years of declines. The weakness in physical supply is here to stay and the physical demand is rapidly growing. As the world returns to the Gold Standard the demand for physical gold will overwhelm physical supply.

Notice that I talk about physical supply and demand? For much too long the price of gold was set in the paper market with derivatives that made it possible to make highly leverage bets that caused serious volatility in the price of gold.

The buying of physical gold in the East, with the weakness in the supply, is taking the pricing of gold away from the paper market and putting it into the hands of those buying and selling physical gold.

The paper traders will put up a fight because they like the way they can push the price around to make easy money. But, the war is over, their effects in pricing will become marginal and the easy money for them will be in being paper gold bulls.

Day by day, the reasons to be bullish on gold and gold stocks are getting stronger. Making for a very friendly trend.

Gold Stocks In The News

My highest conviction gold discovery pick Goliath Resources is in the midst of their 2024 drilling program at the Surebet discovery. They are making news on a weekly basis and had a great news release out today.

The headline from the news release puts things into context beautifully, “Goliath Drilling Confirms 100% Of The First 8 Holes Of 2024 Hit Significant Mineralization, 75% Of The Holes Contain Abundant Visible Gold Up To 1.3mm In Size.”

The more they drill at Surebet, the more it reminds of something my mentor in geology told me years ago. He pointed out that exploration projects start out big and as drilling is done they get small, while discoveries that turn into gold mines get better and better the more you drill them. Surebet is certainly on the latter path.

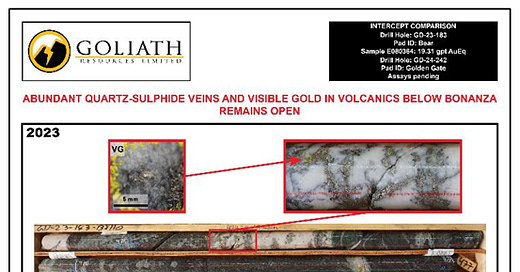

I love when exploration companies show drill core pictures from their drilling, more should as it helps keep their investors and potential investors well informed. Sure it doesn’t guarantee what will come out from the assays, but it certainly shows they have something they want to show and they understand the importance of bringing their audience into the process of drilling for buried treasures.

They had some sweet looking core in the news release, that included visible gold and sulphide mineralization that suggests they are honing in on the heat engine source of the gold mineralizing system and have likely tapped the top of it.

Goliath Resources team does a great job of describing what they have found in their drilling that will help you do your homework. Here is the link to the news from earlier today. I highly recommend you read it as there are plenty of great details about how well their drilling is going.

Juggernaut Exploration (sponsor, see disclosure below) has a new discovery right beside Goliath’s Surebet. They also had news out today that is a great update on how their 2024 drilling campaign at Bingo is progressing.

They are a couple years behind Goliath, but are able to move forward rapidly as they share the exploration camp, drilling company and key geologists with Goliath. And similar geology for that matter.

They, like their next door neighbour, also put out highly informative news releases. Here is the headline, “JUGGERNAUT DRILLS EXTENSIVE MINERALIZATION CONTAINING CHALCOPYRITE AND PYRRHOTITE IN SEMI-MASSIVE TO MASSIVE SULPHIDES IN QUARTZ VEIN AND BRECCIA IN 100 % OF FIRST 6 HOLES OUT OF 27 HOLES - REMAINS WIDE OPEN - BINGO PROPERTY, GOLDEN TRIANGLE, B.C.”

Their CEO had a quote in the news release today that summarizes things nicely. Dan Stuart, President and CEO of Juggernaut Exploration, states, “Intersecting sulphide mineralization in 100 % of all holes drilled so far this season up to 11.66 meters in width is great news for the Company and its shareholders. As we move the drill along to drill test the mineralization at depth as well as continue with surface mapping and prospecting, we’ll gain a better understanding of the system at play. We look forward to releasing visual results as the program progresses and will announce assay results once they are received, compiled, and interpreted.”

Along with great details about their 2024 drilling campaign, they also included a series of drill holes that show the mineralization they hit so far at Bingo. Please read the news release as it will help you with your due diligence on Juggernaut Exploration.

The Golden Triangle of British Columbia has treated me very well over the years. I have only ever picked a handful of companies. Two of them, GT Gold and Pretium Resources, I picked early in their success and reported on them until they were both taken over.

Obviously, past success is no guarantee of future success. But, Goliath Resources and Juggernaut Exploration are my current Dynamic Duo of the Golden Triangle. I’m impressed with what they have both drilled into and think they have great futures ahead of them.

Borealis Mining (sponsor, see disclosure below) announced today that tomorrow morning they will start trading as a public company. I’ve written reports on them and interviewed their key management to express how much I like what they did as a private company and how that has set them up for success as a public company.

Tomorrow morning, I will be interviewing their key management to discuss the milestone of transitioning from a private company to a publicly trading company. We will discuss the work they have done prior to listing, pending developments and more.

To find the previous reports and interviews on Borealis Mining, and others, please visit our website at rocksandstocks.substack.com. If you aren’t a subscriber, I invite you to become one so you can receive all our content.

All the best,

Allan Barry Laboucan

Disclosure

Allan Barry Laboucan is a shareholder of Goliath Resources and holds warrants to increase his position. Juggernaut Exploration is a sponsor of Rocks And Stocks News, content creation about them is for the benefit of the company. Sponsors also benefit readers of the reports as it makes content creation possible for no charge to readers. Borealis Mining is a sponsor of Rocks And Stocks News, content creation about them is for the benefit of the company. Sponsors also benefit readers of the reports as it makes content creation possible for no charge to readers. Allan Barry Laboucan is a shareholder of Borealis Mining and is a consultant for them as well.

Rocks And Stocks News does not make buying or selling recommendations. The reports are for information purposes only. Sponsors pay a fee to Rocks And Stocks News for content creation. The business model of Rocks And Stocks News is to fund research and reporting on the sector, picks and sponsors through corporate sponsorship. We are thankful to sponsors for enabling commentary free of charge to readers and viewers of the reports. When reporting on sponsors it is on behalf of the sponsors discussed in the portion of the report mentioning the sponsor. Before making any investment decision it is important for you to speak with your financial advisors to consider your risk profile. It is also important to do your homework. To help in that process, Rocks And Stocks News means to be a gateway by doing reports and interviews of management of sponsors and picks. The reports and interviews should not be considered investment advice. Allan Barry Laboucan is the founder and owner of Rocks And Stocks News, he has worked in the mining sector since 1993 and has been reporting on the sector since 2005. He has worked with and been mentored by very talented geoscientists in geology, geochemistry and geophysics. He uses the skills he has picked up during his career to assess sponsors and picks in the reports. Whether a company is a pick or a sponsor they go through the same filter and are reported on when important news is made that Allan Barry Laboucan wants to discuss on the Rocks And Stocks News platform. He may own shares in sponsors and picks for investment purposes which he discloses when discussing them in the reports.