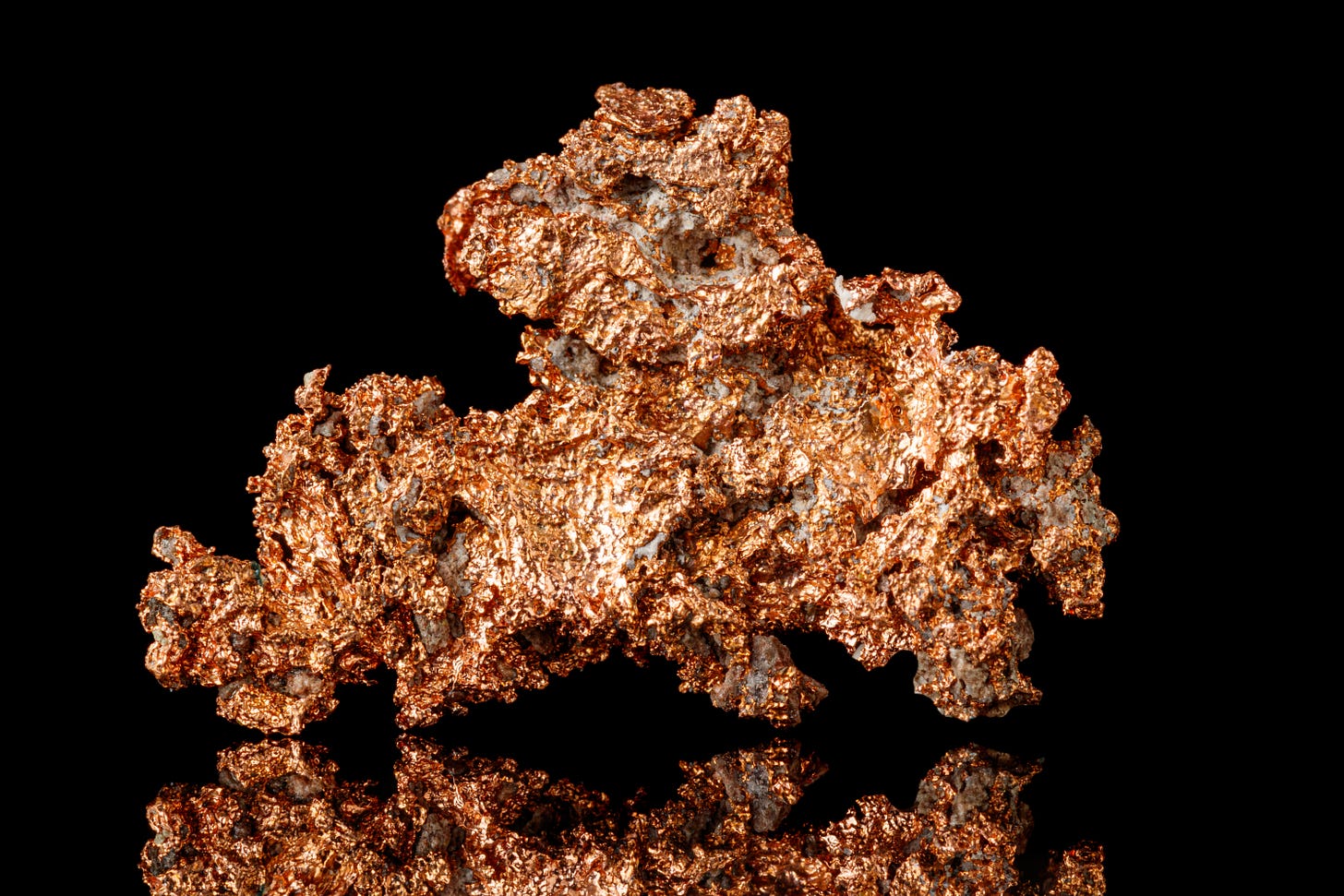

Doctor Copper’s Supply Chain Is Weak While Demand Is Powerful Setting Copper Up To Go Much Higher

Companies featured in this report include McEwen Mining, Alta Copper, NevGold Corp. and Goliath Resources

The key metals we follow at Rocks And Stocks News are gold, silver and copper. I believe there is a metals bull market starting that will be stronger than the 2001 to 2012 metals bull market. Back then, a key factor was the emergence of developing economies in Asia led by China and India.

Demand was strong for many metals, while supply was not well prepared. They had gone through significant long-term underinvestment in exploration, with not enough projects going through development or new mine building.

Gold is in a powerful bull market due to the Death Spiral of Debt and the BRICS nations moving to the Gold Standard. Silver is a monetary metal, plus is crucial for solar panels, there is a looming supply crunch forming.

Silver still has a long way to go to get to trade up to its all time high, but it has started to get more bullish. Copper recently hit its all time high and is also heading toward a near and long term supply crunch.

I report on gold often because it is the leader amongst metals when entering into a metals bull market. Where gold goes, so goes the metals.

Gold made a major breakout this year and since then has made a series of new record highs. I see more of that coming. To have a serious gold bull market, silver needs to join the party which it recently has done. Copper is trading in a similar trend as gold which is good confirmation of the gold bull market.

In my recent report, I went over reasons I’m bullish on silver and discussed my two picks in silver. In this report, I wanted to focus on copper.

I’ve been working in the mining sector for a few decades and during that time, I have never seen copper with such a strong bullish setup.

During the 1990s it went down to 60 cents per pound, which curtailed work on the copper pipeline and then when the developing economies started to grow rapidly, the demand for copper was powerful and it performed very well in the 2001 to 2011 metals bull market.

Now we have another metals bull market emerging that has been led by gold with copper hot on its heels. This time around, demand from emerging economies is still strong, as it is in other emerging economies. Another source of strong demand is coming from a move to alternative energy sources, as well as from electric vehicles.

Technologies like cloud computing, and crypto currencies consume plenty of copper. Out of left field Artificial Intelligence has burst onto the scene and when it comes to energy demand from technology, AI uses a massive amount of energy. Yet, when you look at long-term forecasts of brokerage house analysts, AI is not really even in the mix.

With the hype machine on full force for AI, I often think when I hear the pitch is where are they going to get all the copper to power the AI dreams?

Another major issue for copper demand is the aging power grids in developed economies needed to bring the energy to the consumers for all these products that need immense power.

It is pretty shocking that in 2024, when it gets hot and people in California and Texas have to crank up their air conditioning, it stresses their power grids so badly. To think that in this day and age rolling blackouts can happen in a modern country like America is remarkable.

If there was wide adoption of electric vehicles, the power grid in developed and emerging economies would be dysfunctional.

It is fine to have all these ambitious goals to modernize the world, but before folks get too far out on their skies, they need to realize it all requires the most critical metal copper. And that comes from mining.

If you want vast adoption of electric vehicles, powered by alternative energy sources, then you can’t have the not in my backyard mentality.

The bottom line is the world is progressing on all the fronts I described earlier, the only kink in the plan is that there is not enough current or future copper needed to make it happen. Folks are going to have to learn to hug their copper miners.

When I first got in the mining industry, you needed 1% copper or better to be taken seriously about exploration, development and mining. These days, that threshold is half that grade so miners need to move twice as much rock to get the same amount of copper.

One of two things will have to happen. Either the world uses less copper or the price of copper goes much higher to incentivize miners to get busy with exploration and development. As it is now, the world is depending on a lot of ancient mines, that aren’t close to being able to supply the demands right in front of us.

My bet is that the price of copper goes much higher.

I’m always on that hunt for good copper companies. What is very challenging is to find them. Whether looking for explorers or developers, the menu is very small. Which ultimately gives me the confidence to be extremely bullish on copper. The demand is easy to see, the supply cupboard is getting more bare by the day.

Copper Stock Picks

The first two companies are copper development companies. When looking at the supply chain for copper, understanding the projects in the development pipeline gives a very good view of the long-term supply chain.

There just aren’t enough development projects to replace the current mines, and looking out only a few years the supply chain is not prepared to meet the demand. It looks like shaky supply and supply crunches are a thing of the future for many years.

I would also point out that practically every major mining company wants more copper production. They have the most data concerning the supply and demand for copper. Their actions speak volumes about the value of investing in copper.

Their menu of projects in development is very small, I can see that buyouts will pick up in the near term. Likely when copper is moving higher and thus at premiums from current valuations of what is available from explorers, developers, junior miners and mid-tiers.

McEwen Mining

They are the largest shareholder (49.1%) of private company McEwen Copper. The key asset for McEwen Copper is they own one of the best copper development projects worldwide.

Their Los Azules is in the top 10 undeveloped copper projects in the world and also is in the lowest quartile of costs. They are currently advancing it to a feasibility study.

McEwen Copper also has an impressive group of investors. Rob McEwen is a major investor, as is Nuton (a Rio Tinto venture) and Stellantis (one of the largest automobile manufacturers worldwide). The investment by Stellantis is the first time a major car builder has invested directly into a copper project.

Whether one looks at the economic metrics, or the quality of investors, it is clear how impressive Los Azules is and is on a path to become a near-term copper mine.

Not only is it a project that is going to be a future mine, it is also being built as an example of what mines of the future should be. They want it to be an example to other miners, concerning how they use water and energy as well as making it a mine that miners want to work for due to its modern facility to live in when working at the mine.

They recently announced that McEwen Copper is doing a financing of XX million, at a price of XX per share.

McEwen Mining is also a high cost gold miner that is doing important work to increase their production and bring down their costs.

McEwen Mining gives its investors exposure to gold mining and a large ownership of one of the best copper development projects in the copper sector.

Alta Copper (sponsor, see disclosure below)

They are a junior that owns 100% of the Canariaco project, which is an exceptional copper development project. It is in the top 10 undeveloped copper projects in grade and size.

They have recently completed a PEA that showed robust metrics using a copper price that is significantly lower than the current price of copper. By extension, it shows remarkable growth in the economic performance using the current price of copper and it only gets better as copper goes higher.

Major mining company Fortescue owns 31% of the stock in Alta Copper. The fact that Fortescue invested in Alta Copper is a good sign they think Canariaco can become a major mining company sized copper mine.

They have done their due diligence and decided to invest, so they have done the homework for investors and like what they see which is a strong endorsement of the project's potential.

In addition to investing in Alta Copper, Fortescue had the opportunity to name a representative to the board. They chose to add their top mine builder and mine operator to the board, which is another strong sign that they think Canariaco can become a future mine.

Peru is also making great strides to become a more mining-friendly jurisdiction after several years of going the opposite direction. The Peruvian government has made very positive comments about permitting key projects. Recently, Southern Copper (a subsidiary of Grupo Mexico) announced that they are resuming mine development at their Tia Maria project in Peru.

Key milestones the company has in front of it is additional drilling to upgrade the resources and for expansion drilling, plus a feasibility study.

The copper mining business needs plenty more projects in the development stages. Canariaco compares favourably in size and grade, with robust economics including a 24% IRR. Yet, relative to their peers, they still have a modest valuation.

The next group of picks are explorers, there is an extreme need for more copper exploration that leads to success moving discoveries to advance to the next stages of economic evaluation and development.

NevGold Corp. (sponsor, see disclosure below)

They are well positioned in the Idaho copper porphyry play that has gained the attention of several major mining companies since the discovery made by Hercules Metals. Plus, they have an exceptional gold project in the state as well.

Shortly after Hercules Metals announced their discovery hole, a staking rush ensued and NevGold was able to be a first mover due to their experience in Idaho with their Nutmeg oxide gold project. They picked up a key strategic project, in the same kind of geology and structures, plus historical mining, like at the Hercules Metals project.

When they announced recent sampling results, they also included a claim map showing that Barrick has staked all the ground between the Hercules Metals ground and NevGold’s Zeus project. This is a good sign that NevGold’s interpretation of the geology was sound as Barrick is all around them now.

Their sampling results also confirms the prospectivity of their Zeus project as it returned promising results from limited sampling. Now they are getting in there for more extensive sampling and geological mapping as well as geophysics. This will help them prepare for drilling in the early fall.

I’m also a big fan of their Nutmeg project. It has a resource of 1.2 million ounces of gold in the oxides. This could be an excellent starter pit, but the real prize for me is what is below the oxides. They feel the source of the oxide gold is a cluster of epithermal veins immediately below the oxide zones.

I’m impressed with the potential below the oxides at Nutmeg, primarily because of the zonation of grade in an epithermal vein system. To get the high grades they did in the oxides, which is above the boiling zone (also considered the bonanza zone by many in the exploration business) is remarkable.

It suggests that the boiling zone of the epithermal veins system below could be a series of gold rich epithermal veins. Most of the time, epithermal veins that become mines are silver rich or gold and silver rich. Gold rich ones are unique, Midas in Nevada and Hishikari in Japan are two well known examples.

Goliath Resources

Goliath is my highest conviction gold discovery pick. So why am I including them in this copper report? They are in the Golden Triangle of British Columbia, and while they are focused on their Surebet gold discovery, they also have a copper-gold VMS target called Treasure Island that will see drilling this season.

The Eskay Creek mine put the Golden Triangle on the map because it was one of the highest grade gold mines in the world at one time. It was a gold-silver rich VMS deposit. Sampling at Treasure Island has returned high-grade gold and copper. It is located in close proximity to a past producing VMS mine.

Whenever I hear about high-grade VMS projects in the Golden Triangle, I pay close attention due to the success of the Eskay Creek mine. Treasure Island is a very large outcrop with widespread sulphides and high-grade gold and copper, which has been sampled, but never drilled.

Based on the outcrop and widespread mineralization, it looks to me like Goliath has the potential to make a high-grade VMS discovery to complement their exceptional Surebet gold discovery.

Other notable copper explorers that are official picks are American Eagle Gold, Hercules Metals and Abitibi Metals. I have written them up as picks in past reports, plus did initial interviews with American Eagle Gold and Abitibi Metals.

Next, I would like to do additional interviews with American Eagle Gold and Abitibi Metals, plus do an initial interview with Hercules Metals. I’m a big fan of all three, I think they all have excellent copper exploration projects and I would really like to get them on as regular interview guests to dig deeper into their evolving projects.

I have reached out to management of all three and hope to be able to schedule interviews with them soon, they are all very busy advancing their various projects.

All the best,

Allan Barry Laboucan

Disclosure

Alta Copper is a sponsor of Rocks And Stocks News, they are presented for the benefit of the company. Their sponsorship also benefits readers and viewers of Rocks And Stocks News reports as they are provided free of charge. Allan Barry Laboucan is a shareholder of Alta Copper’s common shares. NevGold Corp. is a sponsor of Rocks And Stocks News, they are presented for the benefit of the company. Their sponsorship also benefits readers and viewers of Rocks And Stocks News reports as they are provided free of charge. Allan Barry Laboucan is a shareholder of Goliath Resources’ common share and also own warrants to purchase additional shares.

Rocks And Stocks News does not make buying or selling recommendations. The reports are for information purposes only. Sponsors pay a fee to Rocks And Stocks News for content creation. The business model of Rocks And Stocks News is to fund research and reporting on the sector, picks and sponsors through corporate sponsorship. We are thankful to sponsors for enabling commentary free of charge to readers and viewers of the reports. When reporting on sponsors it is on behalf of the sponsors discussed in the portion of the report mentioning the sponsor. Before making any investment decision it is important for you to speak with your financial advisors to consider your risk profile. It is also important to do your homework. To help in that process, Rocks And Stocks News means to be a gateway by doing reports and interviews of management of sponsors and picks. The reports and interviews should not be considered investment advice. Allan Barry Laboucan is the founder and owner of Rocks And Stocks News, he has worked in the mining sector since 1993 and has been reporting on the sector since 2005. He has worked with and been mentored by very talented geoscientists in geology, geochemistry and geophysics. He uses the skills he has picked up during his career to assess sponsors and picks in the reports. Whether a company is a pick or a sponsor they go through the same filter and are reported on when important news is made that Allan Barry Laboucan wants to discuss on the Rocks And Stocks News platform. He may own shares in sponsors and picks for investment purposes which he discloses when discussing them in the reports.