Alta Copper Has What The Copper Mining Business Needs

I'm very bullish on copper due to supply and demand fundamentals. But, finding high quality copper companies is not easy. Alta Copper has an important copper project.

Copper is heading toward supply shocks at a rapid pace. Demand from alternative energy sources, the electric vehicle revolution, rewiring the aging power grids of developed economies, and building developing nations infrastructure will overwhelm the supply chain.

To meet the demands from these sources will require several once in a generation new mines to be in production over the next 10 years. Due to long term lack of investment in exploration the discovery of new mines has been in decline for the past four decades. Looking at the pipeline of new mines in development and those in advanced exploration it isn’t going to happen.

What will need to happen is that the price of copper will have to go up dramatically to make more mines in various stages of development and advanced exploration viable. Or, the demand will have to stop growing. Of those two scenarios, copper going much higher is most likely.

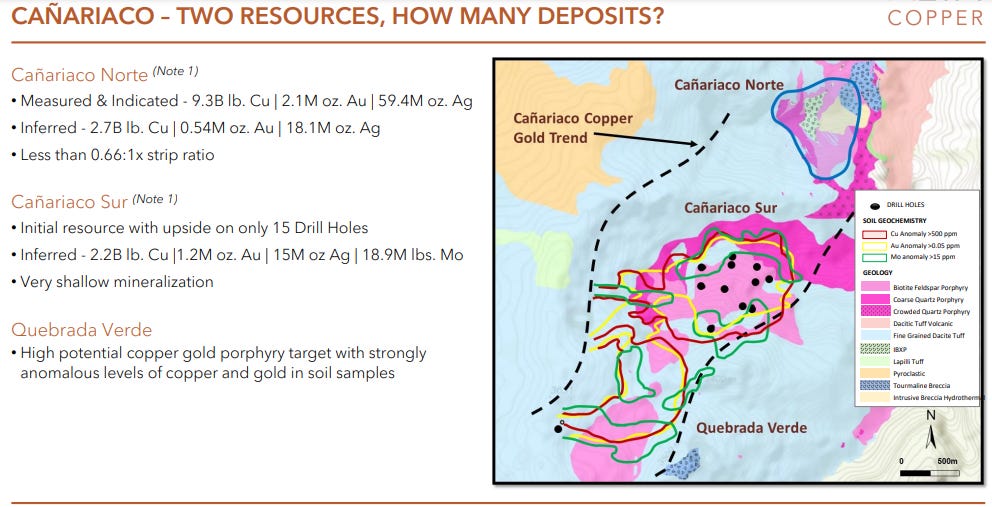

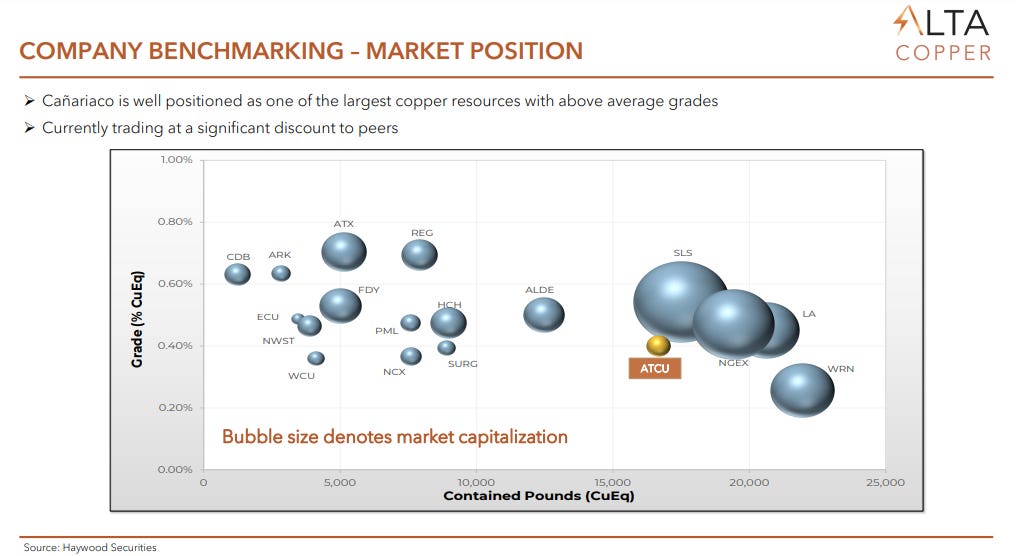

Alta Copper (ATCU.T) is a sponsor of the reports at Rocks And Stocks News and they have a copper resource that ranks it in the top 10 in grade and size for undeveloped copper projects. They have what major mining companies need. They have the kind of project that has the potential to be a future copper mine that will likely be built by a much larger mining company.

Evidence of how weak the supply chain for copper is can be seen in the inventories at the metals warehouses. They are down to days of supply needed for daily copper demand. This is a critical problem that few seem to understand.

The way copper is trading, it seems as though the market is gambling on an economic slowdown to help the supply problem. If there is a recession, it will only force the Fed and other central bankers to slash interest rates and pump in liquidity. Take a wild guess where that stimulus will go. Governments throughout the world want alternative energy sources and the electric vehicle revolution to happen. So if they are in the stimulus mood, they will pump money into these efforts.

As you can imagine, I’m very bullish on copper. But, what I have a hard time finding are good copper exploration stories and projects that can become new mines. Alta Copper has both covered.

Alta Copper’s 100% owned Canariaco project is located in a prolific mining district of northern Peru. This is a region of Peru that benefits greatly from mining.

In May, they announced closing a private placement from two strategic investors. Those investors were Whittle Equity Pty Ltd. (“Whittle”) and Nascent Exploration Pty Ltd., a wholly owned subsidiary of Fortescue Metals Group Ltd.

In the news release for this financing they mentioned that part of the proceeds will be used for an optimized NI 43-101 Preliminary Economic Assessment currently underway and targeted for publication by Q3 2023.

There was an excellent quote from Joanne Freeze in the news release, “We are very excited about the upcoming introduction of Alta Copper Corp., an emerging copper developer advancing with the global shift toward electrification and decarbonization and an updated PEA on Cañariaco where several opportunities to further improve already robust project economics have been identified as well as carbon neutralization and further Environmental, Social and Governance (“ESG”) benefits.”

The strategic investors are important. In Fortescue you have a major mining company, experienced at mining in Peru that holds over 25% of the shares in Alta Copper.

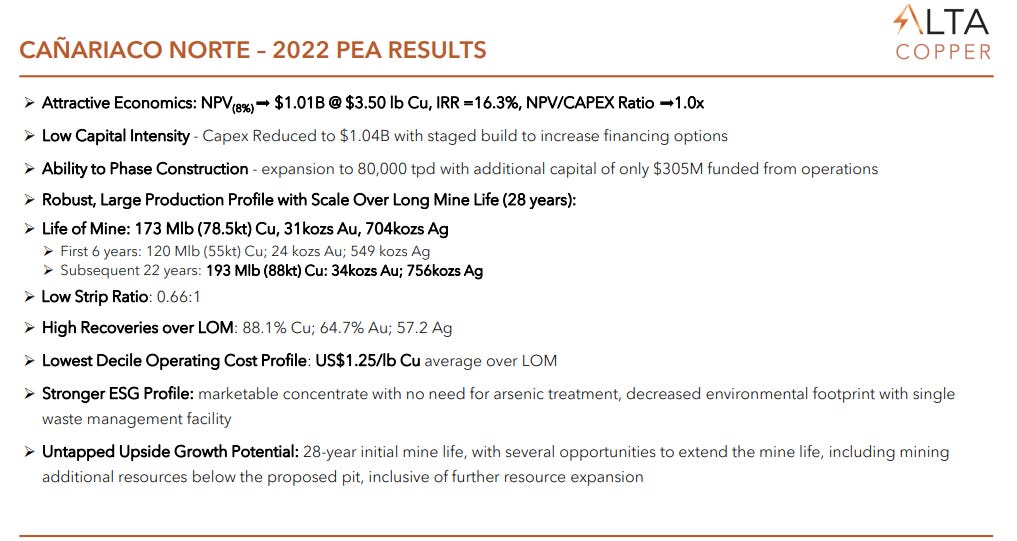

Whittle Consulting is also worth noting as they are experts in optimizing projects and are doing that work now for an Optimized PEA for Canariaco. The current PEA shows robust economics that has the potential to be enhanced by Whittle’s work. Whittle recently did the same kind of work for McEwen Copper that had a significant impact on their project’s economic fundamentals.

Another important near term catalyst is they are working on permits to drill 20,000 metres to test several targets.

Analysts at Haywood Securities put out a report that has an excellent image that helps to understand their valuation relative to peers.

Alta Copper has plenty of catalysts ahead of them, including an Optimized PEA being done by highly respected experts in this kind of work, plus additional drilling. Of course another key catalyst will be a bull market for copper.

I don’t think the bull market for copper is an if situation, but a when. I suspect it is a lot closer than many think. The supply chain doesn’t have enough exploration or new mine development and the old mines are strained to keep up with demand.

As copper moves higher it will bring in new investors looking for copper stocks, but they will have a limited menu to choose from. I know this well because I’m very bullish on copper, and I’m constantly looking for copper companies, but I have a hard time finding them.

In Closing

I’m pleased to have Alta Copper as a new sponsor because I think they have what the copper mining industry needs, namely, a copper project that looks to have the potential to become a future copper mine. I will be doing a series of interviews with their management and discussing them in my sector reports.

I’m a big promoter of investors doing their homework. Ultimately, well informed shareholders that understand the companies they invest in, and have reasonable time frames for companies to reach their success, are prone to make logical investment decisions not emotional ones. This is a recipe for success investing in any sector.

All the best,

Allan

Disclaimer

Sponsors pay a fee, which enables me to do the work I do as an advocate for them and the mining sector. They are not presented with a goal to affect the valuation up or down. What I produce is on a best efforts basis, sponsors or picks don’t get to plan my schedule or my reporting, nor do they get editing privileges. Whether a company is a sponsor or not, they all have to pass the same criteria of what I look for in companies I report on, based on my extensive experience in the mining sector. I am focused on developments of merit that I want to ask questions about in interviews or think I can offer insights helpful to my audience that follows my reports. As always, my reports are for information purposes only, they are not investment advice, it is important for you to speak with your financial advisors to determine if the companies I report on are suitable for you. I don’t make buying or selling recommendations, that is up to you and your financial advisors to decide. No matter what sector or company you are considering to invest in, I think it is crucial to do your homework to better understand the sector and company. I strongly believe that the interviews I do with management, and reports I put out, are a good starting point in your due diligence efforts. I recommend you also check out their websites for news releases, corporate presentations, as well as other information, that will help you in doing research on the companies in my reports, whether sponsors or picks.